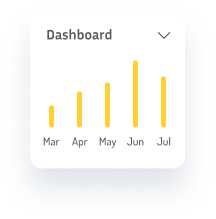

Next-Day Funding

Our Flawless transaction process ensures that merchants receive next-day funding for all purchases. This rapid turnaround helps maintain cash flow and supports business operations without delays.

Omni Credit is your go-to revolving line of credit, designed to provide financial flexibility for all your shopping needs.

Our Flawless transaction process ensures that merchants receive next-day funding for all purchases. This rapid turnaround helps maintain cash flow and supports business operations without delays.

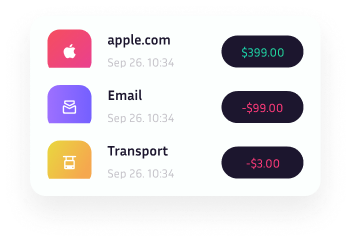

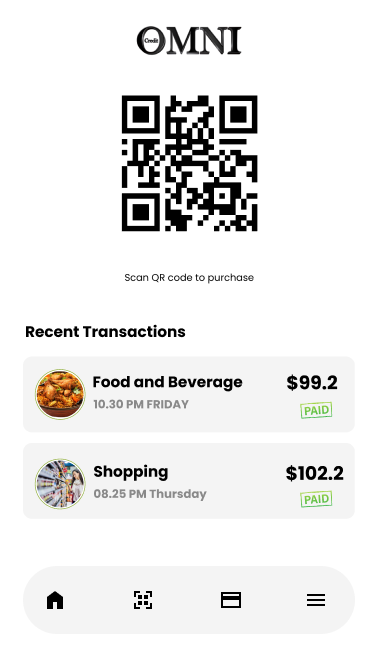

Omni Credit is designed for versatility. Whether you’re shopping online or in-store, our credit solution is accepted across a wide range of industries, including food and beverage, retail, and more. Enjoy the freedom to make purchases wherever you need.

We prioritize safety and compliance. By capturing legal IDs and phone numbers, Omni Credit operates efficiently in age-restricted environments. This ensures that all transactions are secure and meet regulatory requirements, giving both merchants and customers peace of mind.

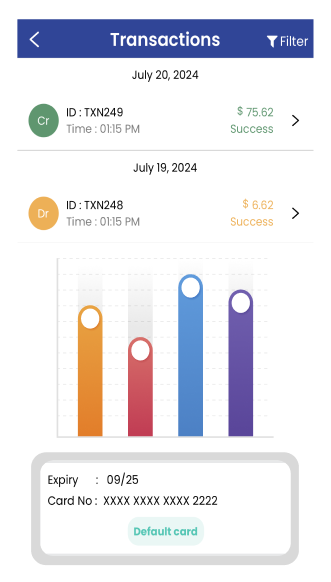

Managing your Omni Credit account is simple and convenient. Your mobile phone number serves as your account number, allowing you to effortlessly track your spending, check your balance, and make payments. This user-friendly approach means you can handle your finances anytime, anywhere.

There are many variations of passages of Lorem Ipsum available but them

majority have

suffered alteration form injected.

(Bad Credit, No Credit)

(Okay Credit)

(Good Credit)

There are many variations of passages of Lorem Ipsum available but the word.

There are many variations of passages of Lorem Ipsum available but the word.

There are many variations of passages of Lorem Ipsum available but the word.